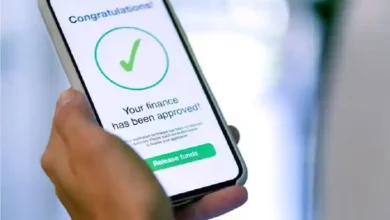

NIRSAL MICROFINANCE SME LOAN: Empowering Small Businesses for Growth 2023

Are you a small business owner looking to take your venture to the next level? In today’s competitive market, access to funding is crucial for sustainable growth, and that’s where the NIRSAL Microfinance SME Loan comes into play. This article will walk you through the key aspects of this loan, how it can benefit your business, and the steps to secure it.

Also Read: Recruitment: Immersion Program of Young Graduates in ECOWAS Institutions | 2024

Introduction

In the dynamic landscape of business, small and medium-sized enterprises (SMEs) play a pivotal role in driving economic growth and job creation. However, limited access to funds often hinders their expansion and innovation. The NIRSAL Microfinance SME Loan is designed to bridge this gap and empower SMEs to reach their full potential.

Understanding NIRSAL Microfinance SME Loan

Features and Benefits

The NIRSAL Microfinance SME Loan comes with a host of features tailored to meet the unique needs of small businesses. From competitive interest rates to flexible repayment terms, this loan is designed to provide financial assistance without burdening entrepreneurs.

Eligibility Criteria

To avail of this loan, your business should meet certain eligibility criteria, including a viable business plan, a positive credit history, and adherence to regulatory requirements. This ensures that the loan is extended to businesses with genuine growth potential.

Application Process

Applying for the NIRSAL Microfinance SME Loan is straightforward. It involves submitting necessary documents, a comprehensive loan proposal, and fulfilling collateral requirements. The streamlined application process ensures that you can access the funds quickly and efficiently.

Empowering Small Businesses

Fueling Expansion

With the NIRSAL Microfinance SME Loan, expanding your business operations is within reach. Whether you’re looking to open new branches, enter new markets, or invest in advanced technologies, this loan provides the financial backing you need.

Boosting Working Capital

Maintaining a healthy cash flow is essential for SMEs. This loan can be used to bolster your working capital, ensuring that you can cover operational expenses, manage inventory, and meet day-to-day financial obligations seamlessly.

Enhancing Productivity

Investing in modern equipment and technology can significantly enhance your productivity and competitiveness. The NIRSAL Microfinance SME Loan enables you to acquire the tools you need to optimize your processes and deliver better products or services.

Why Choose NIRSAL Microfinance?

Tailored Solutions

Unlike traditional lenders, NIRSAL Microfinance understands the unique challenges faced by SMEs. Their loan solutions are tailored to address these challenges and provide the necessary financial support to drive growth.

Competitive Interest Rates

High-interest rates can deter businesses from seeking loans. NIRSAL Microfinance offers competitive interest rates, ensuring that you can access funds without incurring excessive financial burdens.

Expert Financial Advice

Beyond the loan, NIRSAL Microfinance offers expert financial advice and guidance. Their experienced professionals can help you make informed decisions that align with your business goals.

Steps to Secure Your SME Loan

Documentation

Gather the required documents, including business registration, financial statements, and tax returns. These documents demonstrate your business’s credibility and repayment capacity.

Loan Proposal

Craft a compelling loan proposal that outlines how you intend to use the funds and how it will contribute to your business’s growth. A well-structured proposal enhances your chances of loan approval.

Collateral Requirements

While collateral may be required, NIRSAL Microfinance offers flexible options. This ensures that even businesses with limited assets can secure the loan they need.

Making the Most of Your Loan

Strategic Financial Management

Upon securing the loan, create a strategic financial plan. Allocate the funds wisely to areas that will yield the highest returns, ensuring the sustainable growth of your business.

Seizing Growth Opportunities

The NIRSAL Microfinance SME Loan provides you with the opportunity to capitalize on market trends and expansion possibilities. Stay vigilant for opportunities that align with your business’s strengths.

- For Household (500k) Apply Now

- For SME (750k) Apply Now

Conclusion

The NIRSAL Microfinance SME Loan is a game-changer for small businesses aspiring to achieve substantial growth. By offering accessible funds, competitive rates, and expert guidance, NIRSAL Microfinance is empowering entrepreneurs to turn their dreams into reality. Don’t miss out on this opportunity.